How much do you need to start buying stocks in the Philippine Stock Exchange (PSE)?

Interestingly, the answer to that is that “there’s no fixed minimum amount”. The amount you need depends on two factors: (1) the stock’s price and (2) the minimum number of shares you’re allowed to buy.

To help you determine the minimum number of shares that you can buy, you can read our article How to Use the PSE Board Lot. But keep in mind that you also need to consider the fees and charges associated with stock transactions, as these fees increase your buying costs or decrease your selling proceeds.

In this article, we’ll explain the fees and taxes involved in buying and selling stocks and provide sample computations to show you exactly how much you’ll pay when buying stocks and how much cash you’ll receive when selling stocks.

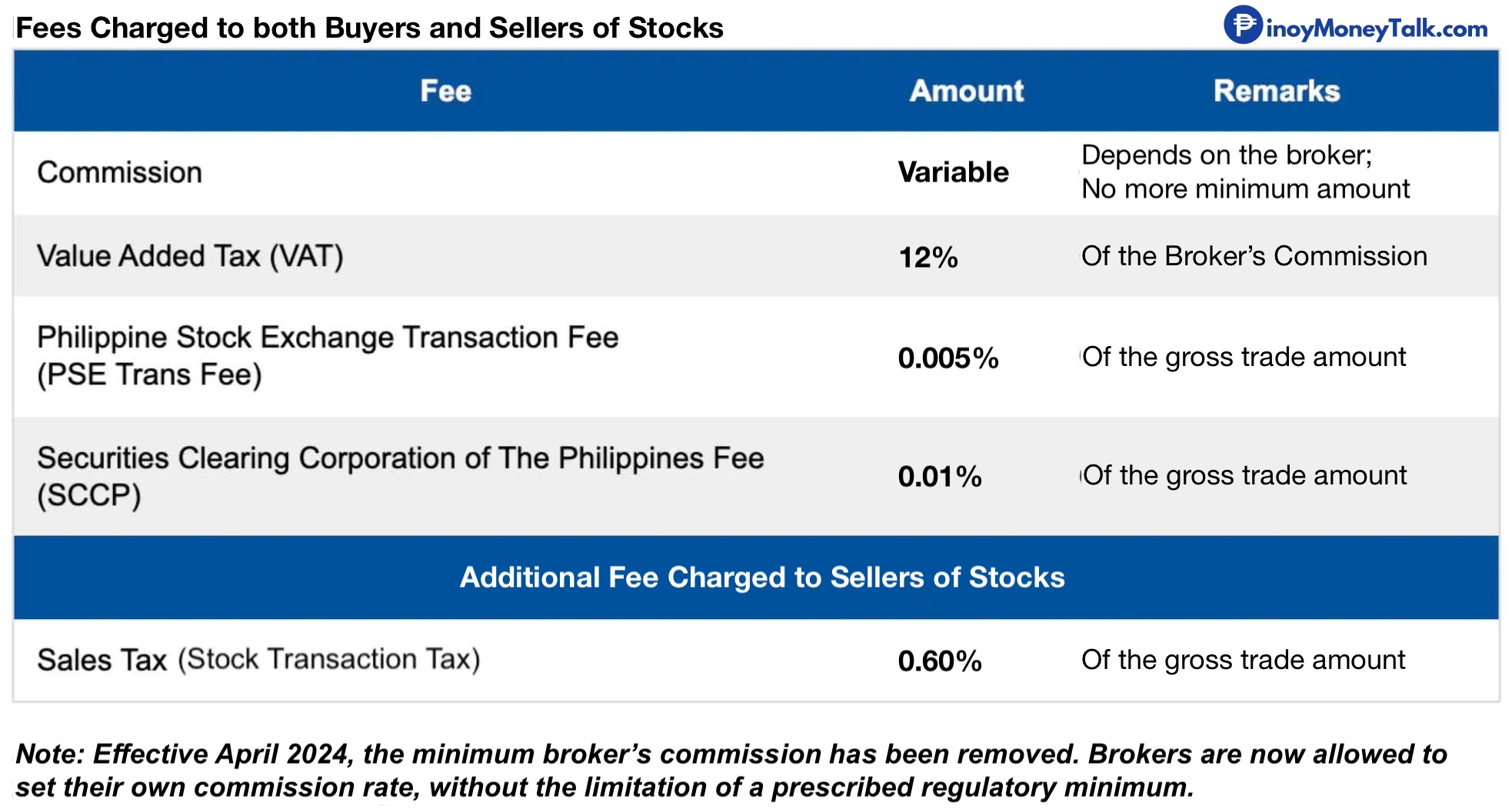

So, what are the fees and charges when buying or selling stocks in the PSE? Whether you’re buying or selling stocks, you’ll need to pay the broker’s commission, the PSE transaction fee, and the clearing fee. If you’re selling stocks, you’ll also pay the additional stock transaction tax.

Here’s a summary of the fees you’ll need to pay when buying and selling stocks in the PSE.

Check out other articles you might find interesting:

- PSE Stock Tips and Recommendations — FREE!

- PSE Stocks Performance under each Philippine President

- My stock got delisted, what should I do?

- The Emotional Cycle of Investing: Why People Lose Money in Stocks

Fees when Buying and Selling stocks in the PSE

1. Broker’s Commission

The broker’s commission is simply the fee charged by stock brokerage companies whenever a trader buys or sells stocks using their platform. This is basically how brokers make money, and brokers apply this fee to every trade — regardless if the customer made a profitable trade or a losing trade. Simply put, as long as your trade order is filled, you’ll have to pay the broker’s commission.

Effective April 2024, the PSE and the Securities and Exchange Commission (SEC) removed the minimum fee requirement, allowing brokers to set their own commission rates in a bid to “help spur trading in the stock market.”

Previously, brokers’ commissions varied per broker, with the PSE requiring a minimum of 0.25% or P20.00, whichever was higher, and a maximum of 1.5% of the traded value.

Most online stockbrokers, such as COL Financial, BPI Trade, and First Metro Securities, charged a 0.25% commission on the transaction amount (or P20.00, whichever was higher). If the broker’s commission fee was less than P20.00, you would still be charged P20.00 regardless.

Trades placed through a live or person-assisted broker were typically charged a commission of 1% to 1.5%.

With the new PSE policy effective April 2024, brokers now have the flexibility to set their own commission rates. Based on our research, the following online stockbrokers in the Philippines currently charge the following broker’s commissions:

| Online Stockbroker | Broker’s Commission |

|---|---|

| COL Financial | 0.25% of gross trade amount |

| BDO Securities | 0.25% of gross trade amount |

| BPI Securities (BPI Trade) | 0.25% of gross trade amount or P20.00, whichever is higher |

| First Metro Securities | 0.25% of gross trade amount |

| PhilStocks | 0.25% of gross trade amount |

| GStocks (AB Capital Securities) | 0.25% of gross trade amount |

Take note that the broker’s commission is also subject to the government’s 12% Value-Added Tax (VAT).

2. SCCP Fee or Clearing Fee

The clearing fee is charged by the Securities Clearing Corporation of the Philippines (SCCP), a wholly-owned subsidiary of the PSE which facilitates clearing and settlement of stock transactions. This fee, set at 0.01% of the transaction amount, ensures the proper transfer of stocks and payment between buyers and sellers.

When you buy a stock, you pay money and, in return, you get ownership of that stock. if you’re selling, you turn over your stocks to the new owner and receive cash proceeds in return.

There is an agency, the SCCP, that facilitates stock clearing and settlement to make it easy for both parties. Simply put, it is the SCCP’s responsibility to ensure the buyer’s payment goes to the seller and the seller’s stocks are transferred to the buyer.

All buying and selling trades are charged a clearing fee or SCCP fee of 0.01% of the transaction amount.

3. PSE Transaction Fee

All buying and selling trades of publicly listed companies have to be coursed through the Philippine Stock Exchange (PSE). For that, the PSE charges 0.005% of the gross trade amount for every completed stock order.

4. Stock Transaction Tax or Sales Tax (For Sellers Only)

As a stock trader, are you required to pay tax (specifically, capital gains tax) on the sale of PSE stocks that you owned?

Simple answer: No. Stock traders do not have to pay capital gains tax (CGT) or report their profits or gains in their Income Tax Return (ITR) submitted to the BIR.

So how does the government make money from each selling transaction? By charging a stock transaction tax of 0.60% of the gross trade amount.

Typically, capital gains tax (CGT) is charged on transactions that result in a profit or gain. However, in the PSE, even if you sell stocks at a loss, you are still required to pay the 0.60% stock transaction tax. This tax applies to all selling transactions, regardless of whether the trade resulted in a profit or a loss.

Summary of PSE Trading Fee and Charges

Here’s a table summarizing the commissions, fees, and taxes charged on buy and sell transactions in the PSE.

| Fees and Charges | Rate or Amount | Charged to |

|---|---|---|

| Broker’s Commission | Depends on the broker; no more minimum amount | Buyers and Sellers of stocks |

| VAT on Broker’s Commission | 12% of Broker’s Commission | Buyers and Sellers of stocks |

| SCCP or Clearing Fee | 0.01% of gross trade amount | Buyers and Sellers of stocks |

| PSE Transaction Fee | 0.005% of gross trade amount | Buyers and Sellers of stocks |

| Stock Transaction Tax | 0.60% of gross trade amount | Sellers only |

Sample Computation: Buying Stocks in the PSE

When buying stocks, it’s important to account for more than just the price per share multiplied by the number of shares. Additional fees and taxes also factor into your total cash-out. Let’s walk through an example to illustrate this.

Example 1. Let’s assume you want to buy 10 shares of Globe Telecom (Stock Code: GLO) at a price of P2,500.00. We’ll also assume that the broker charges a commission of 0.25%. How much will you actually pay for this transaction?

It’s not just P25,000.00 (10 x P2,500.00) because you need to consider the commissions, fees, and taxes.

The computation is as follows:

Gross Transaction Amount: 10 shares of GLO * P2,500 share price = P25,000.00

Add: Broker's Commission: 0.25% * P25,000 = P62.50

Add: VAT on Broker's Commission: 12% * P62.50 = P7.50

Add: SCCP or Clearing Fee: 0.01% * P25,000 = P2.50

Add: PSE Transaction Fee: 0.005% * P25,000 = P1.25

TOTAL BUYING TRANSACTION COST: P25,000.00 + P62.50 + P7.50 + P2.50 + P1.25 = P25,073.75

In short, to buy 10 shares of GLO at P2,500, you need to pay a total of P25,073.75.

Example 2. Let’s assume this time that your broker charges the following commission rate: 0.10% or P10.00, whichever is higher. You plan to buy 100 shares of Cebu Air Inc. (Cebu Pacific – CEB) at P32.00. How much will you need to pay for this buying transaction?

To compute the total amount, let’s break down the costs:

Gross Transaction Amount: 100 shares of CEB * P32.00 share price = P3,200.00

Add: Broker's Commission = P10.00 (Since 0.10% of P3,200.00 amounts to P3.20, which is less than the minimum P10.00, the broker will charge the minimum commission of P10.00, as per its policy.)

Add: VAT on Broker's Commission: 12% * P10.00 = P1.20

Add: SCCP or Clearing Fee: 0.01% * P3,200 = P0.32

Add: PSE Transaction Fee: 0.005% * P3,2000 = P0.16

TOTAL BUYING TRANSACTION COST: P3,200.00 + P10.00 + P1.20 + P0.32 + P0.16 = P3,211.68

Sample Computation: Selling Stocks in the PSE

If you are selling stocks, how much cash will you receive, net of all fees and charges? Here’s a detailed breakdown to help you understand the process.

Basically, you will be paying the same fees above, plus the 0.6% stock transaction or sales tax. Let’s use the same Globe Telecom assumptions from Example 1 for consistency.

Example 3. Instead of buying Globe Telecom (GLO), we will sell 10 shares of GLO at P2,500.00 each. If the broker’s commission rate is 0.25%, how much will our net cash proceeds be?

Gross Transaction Amount: 10 shares * P2,500 share price = P25,000.00

Less: Broker's Commission: 0.25% * P25,000 = P62.50

Less: VAT on Broker's Commission: 12% * P62.50 = P7.50

Less: SCCP or Clearing Fee: 0.01% * P25,000 = P2.50

Less: PSE Transaction Fee: 0.005% * P25,000 = P1.25

Less: Stock Transaction Tax: 0.6% * P25,000 = P150.00

TOTAL CASH PROCEEDS FROM SALE OF STOCKS: P25,000.00 - P62.50 - P7.50 - P2.50 - P1.25 - P150.00 = P24,776.25

In summary, the total amount you’ll receive for this selling transaction is P24,776.25.

Example 4. Compute the net cash proceeds for selling 1,000 shares of a stock at P2.75 each, with a broker charging 0.05% or P5.00, whichever is higher.

Try to compute this yourself before checking the correct answer below. Did you get it right?

Gross Transaction Amount: 1,000 shares * P2.75 share price = P2,7500.00

Less: Broker's Commission = P5.00 (The broker charges P5.00 or 0.05% of the trade amount, i.e,. 0.05% of P2,750.00 = P1.375, whichever is higher. Since P5.00 is higher, the broker's commission will be P5.00.)

Less: VAT on Broker's Commission: 12% * P5.00 = P0.60

Less: SCCP or Clearing Fee: 0.01% * P2,750 = P0.275

Less: PSE Transaction Fee: 0.005% * P2,750 = P0.1375

Less: Stock Transaction Tax: 0.6% * P2,750 = P16.50

TOTAL CASH PROCEEDS FROM SALE OF STOCKS: P2,750.00 - P5.00 - P0.60 - P0.275 - P0.1375 - P16.50 = P2,727.4875 or P2,727.49 (rounded up)

In summary, the total amount you’ll receive for this selling transaction is P2,727.49.

How much should stock prices rise to break even and start to make a profit?

Before you sell your stocks, make sure your selling price covers the fees and charges you incurred when buying the stock, as well as the fees you’ll need to pay when selling it. Otherwise, even if you sell your stock at a slightly higher price than your original purchase price, you might end up booking a loss instead of a gain.

So, at what price should your stock rise before you sell it to ensure a profit? The breakeven point varies depending on the broker’s commission.

As an example, for brokers that charge a 0.25% commission, the stock price needs to rise by at least 1.19% from your acquisition price to book a profit. In short, your stock price should increase by at least 1.19% relative to your purchase price to achieve net gains.

Keep in mind that the computation of the breakeven price depends on the broker’s commission, so make sure to calculate it accurately to avoid surprises.

Check out other articles you might find interesting:

- PSE Stock Tips and Recommendations — FREE!

- PSE Stocks Performance under each Philippine President

- My stock got delisted, what should I do?

- The Emotional Cycle of Investing: Why People Lose Money in Stocks